- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

What is meant by “Sustainable Investing”?

Sustainable investing definition

Sustainable investing is an investing philosophy wherein an investor takes a company's environmental, social, and corporate governance (ESG) factors into account. This allows investment dollars to be used as a tool to promote positive societal impact and corporate responsibility without sacrificing long-term financial returns.

Strategies for investing sustainably include avoiding companies that conflict with ESG principles and seeking out industries that are inherently more sustainable.

There are three subsets of sustainable investing strategies:

1. Socially Responsible Investing (SRI): Avoiding harmful investments that do not align with your values (fossil fuels, for-profit prisons, firearms and weapons, etc.)

2. ESG Investing: Integrating Environmental, Social and Governance (ESG) factors into traditional investment processes to improve a portfolio's long-term risk/return profile.

3. Impact Investing: Targeting positive, measurable social and environmental impact alongside financial returns.

What is the difference between sustainable investing and ESG?

ESG is about making portfolios “less bad.” A sustainable portfolio is about intentionally including companies that are making a positive difference in the world.

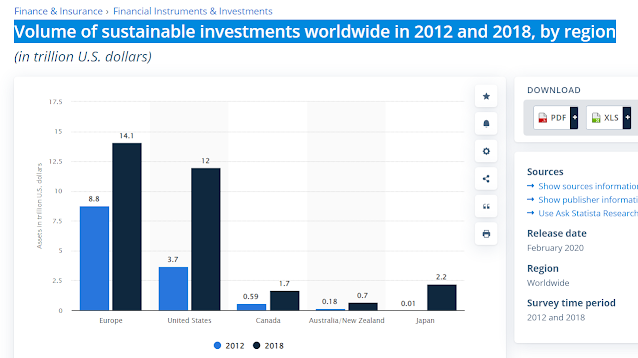

Volume of sustainable investments worldwide in 2012 and 2018, by region

Source: statista.com

According to Statista the most popular factor that would encourage investors to increase their sustainable investments as of 2021 was if they would receive evidence that they deliver better returns.

The second most popular factor, according to 40 percent of responding investors, would be if they were provided with regular reporting showing their social and environmental impact.

What are examples of sustainable investments?

Following the environmental, social, and corporate governance (ESG) framework, there are a wide variety of investments that can be considered “sustainable.” Industries that promote good environmental practices, via more renewable energy sources or by combating air and water pollution, are perhaps the first things that come to mind for most people.

However, sustainable investing can also include investing in companies that support human rights initiatives or a more ethical corporate culture.

Sustainable investing is about investing in progress, and recognizing that companies solving the world's biggest challenges can be best positioned to grow.

What is impact investing app?

FLIT Invest is the first automated investment service aimed to capture the whole spectrum of responsible investments.

- Automated Impact Investing!

- Guilt-free investing App!

- Sustainable Investing!

- Invest today for a Better future!

Register here --> FLIT Investing.

Click my previous article here: How to Dropshipp on Shopify.

- Get link

- X

- Other Apps

Comments

Post a Comment